Research and Surveys

2025 AMC Compensation & Benefits Survey

Lead the Pack: 2025 AMC Compensation & Benefits Survey The 2025 AMC Compensation & Benefits Survey Report is your blueprint for staying competitive in a rapidly evolving labor market. With industry-specific salary data, benefits trends, and incentive practices, this report ensures your compensation strategies match — and exceed — the expectations of today’s workforce. What You’ll Gain:

Pricing:

Don’t rely on guesswork—rely on the only survey built exclusively for AMCs. Order Your Report Today

2022 Financial Performance ResearchConducted by James Gaskin, PhDAMCI recently commissioned the largest independent study on financial performance of nonprofits ever undertaken. The research, conducted by Dr James Gaskin of Brigham Young University finds regardless of tax status or budget size - growth in net income, net revenue, and net assets are stronger when using association management companies (AMCs). The 2022 Growth Report analyzes 990s of more than 10,000 c(3) and c(6) organizations with budgets between $1M and $20M from 2015 – 2019. Results reaffirm a previous 2015 study conducted by the same research team. For additional information on this study click below:

2021/2022 Finance & Operation StudyAMCI’s 2021/22 Finance & Operations study, conducted by Whorton Marketing & Research, will enable you to understand the traits and behaviors of the most successful firms and how you can ready your AMC for a robust 2022 and beyond. The report is now available for sale as follows:

**Please Note: AMC Member Participants will receive a discount code in a separate email. To order an electronic PDF of the final report, please click here. 2020 AMC Model Performance Study

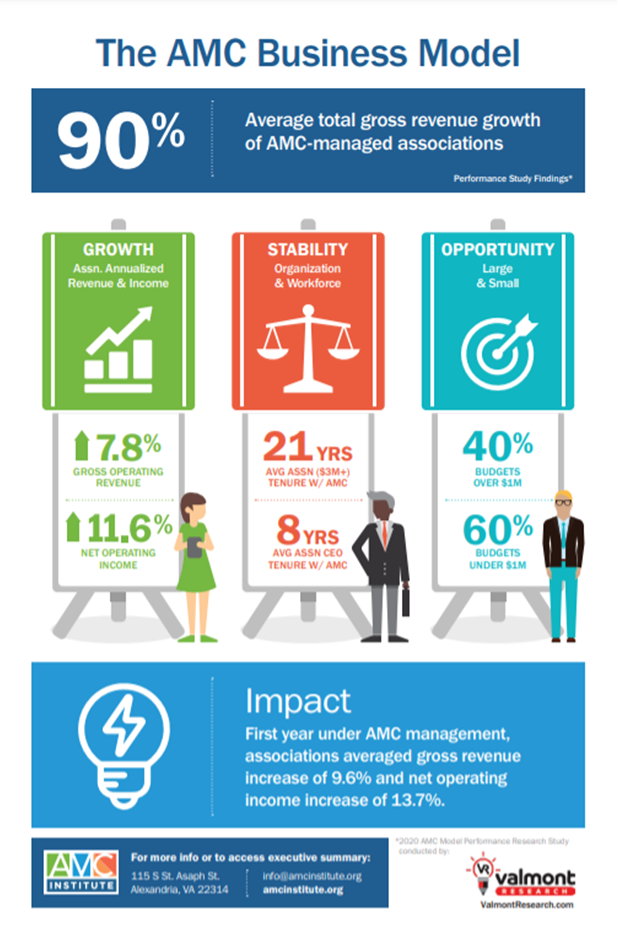

Conducted by Valmont Research, the key findings of this study include: The AMC business model offers stability—associations have been clients of AMCs, on average, for nearly 13 years, and 21% of associations have been clients for 20 years or longer. Large associations are more likely to stay with an AMC for the long haul. The average tenure of associations with $3M+ in gross operating revenue was 22.3 years, about twice as long for associations with revenue of less than $3M. The model offers growth in revenue and income—under AMC management, client associations saw average annualized growth of 7.8% for gross operating revenue and 11.6% for net operating income. The full report can be found here 2017 AMCI Finance & Operations Survey Report2016 AMC Institute Member Impact StudyKey FindingsAMCI’s ongoing commitment to driving awareness and reinforcing the advantages of the AMC model has led to the Institute’s most comprehensive effort to date to quantify the scope and influence of our industry and our members. Under the Board’s direction and led by task force co-chairs John Dee and Denise Jackson, AMCI launched its first in-depth study of the impact of our sector. This survey will be conducted annually. 2016 AMCI InfographicAMC-managed NonprofitsOutpace Sector GrowthAssociations are finding that AMCs can offer a better return and more value delivered to their members. New research by Dr. James Gaskin shows more c6 and c3 organizations using the AMC model. Click here for more information. 2014 AMCI Perception SurveyKey FindingsThe 2014 AMC Institute Perception Survey was conducted to quantify the opinions and knowledge levels of various stakeholders in the association community concerning the association management company (AMC) model. The ultimate purpose of the study was to obtain results that could be used by AMC Institute leadership to create, develop and refine marketing strategies that will increase awareness and use of the AMC management model. |